CR002 TYPES OF SHOPPING CENTERS AND RETAIL REAL ESTATE

Shopping Centers and Retail Real Estate come in different types and configurations depending on their purpose. A Shopping Center is a group of stores (retailers/merchants) and/or service providers typically with on-site parking and storefront identity signage. The size and configuration are dependent on the purpose and the Trade Area that they serve.

A Trade Area is the geographic area from which a Shopping Center or Single-Tenant Net-Lease retail real estate property attains its customers, clients and shoppers. Additionally, many of the employees who work at the property also live in this area. A Primary Trade Area is the surrounding geographic area from which 60-80% of the retail property/shopping center’s sales originate. The limits that define a trade area will be distance (or in urban environments: travel time); natural barriers such as mountains, rivers and parks; man-made barriers such as railroad tracks, highways that may bisect a city and cemeteries. In certain inner-city neighborhoods the trade area also might be defined by one gang territory from another rival gang territory. In rural or far suburban locations the trade area could triple or quadruple in size to encompass the amount of population to support the required sales necessary to make a profit. A common shorthand reference to Trade Area is when someone refers to “Rooftops” as in “Are there enough rooftops and more importantly the right type of rooftops” for the retailers concept.

Additionally, demographics, or the number and incomes of people in the trade area will determine the type of shopping center that serves the particular population. Demographics are destiny, in that specific retailers/service providers look for certain amounts of people with particular income levels. Going back to the “rooftops” concept above; very few locations on earth can support luxury retail (an old leasing dog friend of mine refers to high end retailers as: Gucci, Pucci, Fiorucci and Sushi). On the other hand; drug stores, supermarkets and McDonalds are ubiquitous throughout the world in one form or another.

Shopping centers can be Malls (enclosed or open air) which tend to be larger size (more square footage of leaseable area and total land area) surrounded by parking. The other type of shopping center is the strip center (or classier “Open Center” or Plaza) which typically have parking in front of the stores with the storefronts having street visibility. Strip centers can be as small as 2 stores side by side up to 50 stores in a straight line, “L” or “U” shaped configuration along a main street.

Malls: Malls are an American (Canada, United States) name for larger shopping centers The term represents the most common design type for regional and super-regional shopping centers and has become a generic term for enclosed (roof/climate controlled) centers. Malls are typically enclosed, with a roof over a climate-controlled corridor between two facing rows of stores. Some malls are open to the weather and without a roof over the connecting corridor. Malls are usually one or two levels but can be multiple levels in urban settings.

Mall is also the name used in the Filipino, Indonesian, Kurdish, Latvian, and Norwegian languages. Other languages refer to a Mall as: shopping centre ; Centro comercial ; shopping precinct ; shopping arcade ; 购物中心 ; Gòuwù zhòng xīn ; Winkelcentrum ; Centre commercial ; Einkaufszentrum ; Εμπορικό κέντρο ; Emporikó kéntro ; קֶנִיוֹן ; मॉल ; Pláza ; Verslunarmiðstöð ; meal siopadóireachta ; Centro commerciale ; モール ; Mōru ; 쇼핑 센터 ; syoping senteo ; vir ; Centrum handlowe ; Centru comercial ; Торговый центр ; Torgovyy tsentr ; Tržni centar ; Nákupné centrum ; Köpcenter ; ห้างสรรพสินค้า ; H̄̂āng s̄rrph s̄inkĥā ; Alışveriş Merkezi ; trung tâm mua sắm ; Молл ; I-Mall ; Moll ; mol.

In the early 1950’s, Northland Mall in Southfield, Michigan,USA was designed by architect Victor Gruen and had a four floor Hudson’s Department store surrounded by a ring of shops. This configuration is known as a “Cluster Layout”.

Gruen, who was one of the most influential architects in the world because of his designs for malls and shopping centers describe them as providing a “needed place and opportunity for participation in modern community life that the ancient Greek Agora, the Medieval market and our own town squares provided in the past.” Gruen called his store environments “machines for selling.” As a side note, Gruen was a passionate socialist who arguably did the most to spread capitalism to the masses across America, then the world, by changing the way people shop and organize their communities. Gruen’s most famous design, Southdale Center in Edina Minnesota, USA Malls then morphed into the shape of a “Barbell” with Department Stores (Anchor Tenant) on either end and Small Shops (Specialty Retailers) in a connecting corridor.

Malls eventually got bigger with more department stores to attract people from a wider radius (farther distance). They took on the shape of a “T” or a “Cross” with a “Center Court” connecting the corridors to the Department Stores.

Pioneering Mall Developer A. Alfred Taubman called the Department Stores “People Pumps” because their advertising and or some of the first Malls had a department store in the middle of the design and the Small Shops surrounding it. Mall shapes have now morphed into every imaginable configuration to cram as much Gross Leaseable Area (GLA) onto a project site. See the site plan below for the highly successful Florida Mall, developed by Edward (Eddie) J. Debartolo, Jr., son of Mall of Famer, Edward J. Debartolo, Sr. to see the evolution of the mall. Debartolo was revolutionary with adding a hotel as an anchor in the 1980s. Note the organic growth of new corridors as department stores were added. Then as some of those department stores disappeared their footprints transition into clusters of junior anchor tenants, restaurants and entertainment concepts.

The first fully enclosed Mall was Valley Fair Shopping Center in Appleton, Wisconsin, USA which opened on March 10, 1955. Malls are now a world-wide phenomenon, much to the chagrin of Victor Gruen.

Strip Centers (Open Air Center or Plaza): A strip center is an attached row of stores or service establishments owned or managed as a retail project, with on-site parking usually located in front of the stores. The shopping center is usually (but not always) defined by uniform facades or sign bands which may function as a canopy to cover the walkway directly in front of tenant storefront entrances. Strip centers are most commonly one level unless located in a densely populated area with high land prices putting a premium on land usage. A strip center can be be configured in a straight line (facing major street); “Bar-Bell” shape (facing major street with anchor tenants at the ends of strip); “L” shape (facing major street and to the side facing parking lot), “U” shape (facing major street and both sides facing parking lot).

Strip Center (Straight Line)

“L” Strip Center

“U” Strip Center

Net-Lease Single-Tenant Retail: A stand alone retail store, restaurant or service establishment which can be situated on its own or as a separate parcel within a larger retail development such as an out parcel or an anchor tenant store on a separate pad.

A further distinction of the sub-types of Retailers and the Shopping Centers they choose to locate within is sometimes blurred is the concept of Price Point. Is the retailer “Full Price”,“Discount”, “Off-Price” and Luxury? Luxury retail is delineated not only by higher price points but also better quality, exclusivity and the status the products are implied to confer on the purchaser. Full-Price is, as the name implies, selling at the Manufacturer’s List Price (MLP) or Manufacturer’s Suggested Retail Price (MSRP). Discount retailers, as the name implies, sell merchandise at a discount either through more efficient means of distribution or products that may be similar to full price products but are of inferior quality. Off-Price retailers sell out of season, past season, merchandise that was removed from its original packaging or a return to the manufacturer because they did not sell at “Full” price. Off-Price retailers doffer inconsistent assortment of brand name and fashion-oriented soft goods at low prices. Most Malls have traditionally been anchored by Full-Line Department stores which in turn are merchandised with “Full-Price” specialty stores. Many Full Price retailers will refuse to locate in a Mall or Strip Center with “Discount” retailers. With retail continually evolving and changing the traditional lines of Full-Price, Discount and Off-Price are blurring. The retail market in 2018 continues to bifurcate into Luxury and Low Price/Discount specialists.

The types of shopping center as defined by below Urban Land Institute/International Council of Shopping Centers “Dollars and Cents of Shopping Centers/The SCORE”. These categories and characteristics :

Convenience Center: GLA Size: 5,000 – 30,000 square feet Land Area: ½ – 3 ½ Acres Trade Area Radius: ½ – 1½ miles

Concept: Convenience-Necessity (limited food, fast food, mobile phones, coffee) Anchor Ratio: 0%-80% Anchor Tenant(s) to Specialty Shops

A Convenience Center provides for the sale of personal services and convenience goods similar to those of a neighborhood center. It contains two (2) to twenty (20) stores, with a total gross leasable area of up to 30,000 square feet. A convenience center usually is anchored by some other type of personal/convenience service such as a minimarket, (7-11, Wawa. Convenience center: (small strip center 2 to 20 stores) typically serving a ½ – 1½ mile radius of population.

Neighborhood Center: GLA Size: 30,000 – 150,000 square feet Land Area: 3-15 Acres Trade Area Radius: 1-3 miles

Concept: Convenience-Basics (food, drugs, personal services, fast food, coffee) Anchor Ratio: 30%-50% Anchor Tenant(s) to Specialty Shops

A Neighborhood Center is merchandised and designed to provide “day-to-day” shopping for the needs of consumers in the immediate local area or neighborhood. According to ICSC’s SCORE publication, “roughly half of these centers are anchored by a supermarket, while about a third have a drugstore anchor”. Recently, Dollar Stores and smaller Health Clubs are also serving as secondary anchor tenants in neighborhood shopping centers. These anchors are supported by stores offering: shoe store, women’s/kids clothing, mobile phone store; medical services (doctor/dental office, “Doc-In-The-Box”), health-related products (vitamin or supplement store); postal/mailing/shipping; coffee shop; small Quick Service restaurants; personal services (hair salon, nail salon, dry cleaners, shoe repair, income tax preparer, tanning); in certain situations tobacco/vaping products. A Neighborhood Center is usually configured as a straight-line strip or an “L” with no enclosed walkway or mall area, although a canopy/awning may extend over the small shop storefronts. Neighborhood Shopping Centers frequently have out parcels or pads in front of the parking field which are typically tenanted by fast food, drug store or even supermarket related gas station.

Community Center: GLA Size: 100,000 – 350,000 square feet Land Area: 40-100 Acres Trade Area Radius: 3-6 miles

Concept: General Merchandise; Basics; Some Convenience Anchor Ratio: 40%-60% Anchor Tenant(s) to Specialty Shops

A Community Center typically offers a range of apparel and other soft goods. It has a larger trade area than Convenience and Neighborhood shopping centers. Community Centers are typically anchored by discount department stores (i.e. Walmart, Target ) in addition to supermarkets, drugstores, Off-Price tenants (i.e. TJ Maxx, Marshall’s and Ross) or Home Improvement (Home Depot, Lowe’s and Menards) or sporting goods. The center is usually configured as a strip, in a straight line, or “L” or “U” shape. Community Centers can contain “Full Price” along with “Discount” or “Off-Price” retailers depending on the anchor tenants but this distinction is rapidly fading away as retailers experiment with different sizes, formats and sales channels.

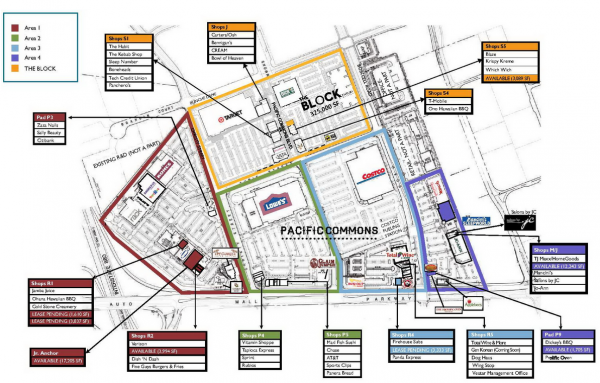

Power Center: GLA Size: 250,000 – 1,000,000 square feet Land Area: 25 – 100 Acres Trade Area Radius: 5 – 15 miles

Concept: Heavy Advertising – Product Category Leaders, Discount, Off-Price Anchor Ratio: 75%-95% Anchor Tenant(s) to Specialty Shops

Power Centers are larger strip centers with multiple National Chain Stores that act as anchor and junior anchor stores (also referred to as “Big Box” stores). The limited “Small Shop” space is typically situated in smaller Out-Parcel strips of 3 – 5 tenants closer to the street as opposed to an In-Line configuration. Typical anchor tenants will include: “Category Killer” (Product Category Leading Retailers that offer a wide selection of a particular category of merchandise, often at low price points) such as Electronics (Best Buy, Fry’s); Pet Supplies (PetSmart, Petco); Sporting Goods (Dick’s, Cabelas, Bass Pro Shops, Scheels, REI); Craft Supplies (Hobby Lobby, Michaels, Jo-Ann). Other Power Center tenants include: Home Improvement Warehouse (Home Depot, Lowes, Menards); Discount Department Store (Walmart, Target); Warehouse Club (Costco, Sam’s, BJ’s); Off-Price (TJ Maxx, Burlington Coat Factory, Ross Stores, Nordstrom Rack, Saks OFF 5th); Books (Barnes & Noble); Toys (Toys R Us); Office Supplies (Office Depot, Staples); Beauty (Ulta). Tenants located in Power Centers are highly promotional using heavy brand advertising and mass marketing to draw traffic and consumers to their stores. The Power Center concept was the brainchild of real estate innovator Merritt Sher of Terranomics. Merritt has also been credited with the first Lifestyle Center (see below). In the past Power Centers were attractive to lenders and institutional buyers because of the number of “Credit Tenants” on the rent roll ensure security of payment. More recently, with retailer bankruptcies and entire product categories susceptible to online retail channels Power Centers have lost some of their investment quality attractractivenes. Smart, well capitalized investors who are able determine quality real estate and retenant/repurpose Big Box vacancies can make some outsized returns now that Power Centers have lost favor with investors because of media hype about the retail real estate apocalypse.

Lifestyle Center: GLA Size: 100,000 – 550,000 square feet Land Area: 10 – 40 Acres Trade Area Radius: 5-15 miles

Concept: Fashion, Food, Specialty Merchandise; Entertainment Anchor Ratio: Predominantly Specialty Shops and Restaurants

The most recent category of shopping center is the Lifestyle Center, which is a shopping center (sometimes combined with residential and offices) that will have higher end mall Specialty Retailer type tenants in an open to the elements format. Lifestyle Centers are sometimes described as a Mall without the Department stores. The developers Poag and McEwen first coined the term “Lifestyle Center. A Lifestyle Center usually combines the features and amenities of a Mall including a pedestrian orientation with stores facing inward and parking surrounding the development. LifeStyle Centers typically do not have anchor tenants but have “Key Tenants” (aka Bell Cow Tenants) which are specialty tenants that draw shopping traffic and create interest with other retailers. Many Lifestyle Centers have a streetscape design with pull-in storefront parking and parking decks. Lifestyle Centers use less land, so they could be developed closer to existing populations and the stores typically have higher sales volumes found in better malls. They are a hybrid of a Mall and a Strip center. Lifestyle Centers are also sometimes branded “Main Street Collections” and can now include residential, office and hotel components which then morph into a Mixed Use Development (see below) or referred to by planning professionals as “Town Center” developments. Sources have also credited Merritt Sher with developing the first Lifestyle Center, The Grove at Shrewsbury in Shrewsbury, New Jersey, USA. In the “If you can’t beat them, join them” category, Oak Brook Mall, one of the best Super Regional Malls in the country (with 5 department stores) has rebranded itself a Lifestyle Center because it has always been outdoors/uncovered and the department stores may eventually all go away.

Regional Center / Regional Mall: GLA Size: 400,000 – 800,000 square feet Land Area: 40-100 Acres Trade Area Radius: 5-15 miles

Concept: General Merchandise; Fashion, Food, Entertainment Anchor Ratio: 50%-70% Anchor Tenant(s) to Specialty Shops

Regional Shopping Centers or Regional Malls are typically enclosed with parking surrounding the building(s)

Regional Malls/Regional Shopping Centers are typically enclosed/covered purpose built shopping centers typically anchored by Full-Line Department Store but more and more by clusters of Specialty Tenants. Small shop tenants have higher concentrations of fashion, apparel, shoes, accessories and jewelry. Newer anchor tenants include Discount Department Store, Multiscreen Movie Theaters and restaurant clusters. The typical layout of a Regional Mall is the stores facing inward with parking lots and parking decks surrounding the center.

Less dominant Regional Malls with weak anchor tenants may soon be extinct. Some of these malls will make great redevelopment opportunities because of the large parcel of land located near major intersections. Many Malls will be converted to Mixed Use as they remain excellent locations for residential and hotel developments. Some parts of these malls may end up as light industrial distribution centers to get e-commerce deliveries closer to consumers. My company, Concordia Realty,has redeveloped 3 regional malls all of which stayed retail but ended up as strip centers. At South Hills Mall in Poughkeepsie, NY the anchor tenants had relocated to a competing mall so we redeveloped the property into a hybrid power center with a mall component in the late 1990s. This result was not as successful as our next redevelopments which included Southgate Mall in Milwaukee, WI. At Southgate, we strategically developed a movie theater in the rear parking lot, relocated Walgreens out of the mall to a front pad while emptying the mall over 2.5 years. Once the mall was empty we completed the demolition, prepared the building pad and sold the entire project to a Walmart developer for $5 million profit. Southgate is currently a thriving Community Center and was the spur for other community redevelopment in the area.

Superregional Center: GLA Size: 1,000,000 + square feet Land Area: 60-120 Acres Trade Area Radius: 10+ miles (Can draw from multiple states or countries)

Concept: General Merchandise; High-End Fashion, Food, Unique Entertainment Anchor Ratio: 50%-70% Anchor Tenant(s) to Specialty Shops

Similar to a regional center, but because of its larger size, a Super-regional Center has more anchors, a deeper selection of merchandise, and draws from a larger population base. In certain Superregional Centers like Mall of America or Woodfield Mall the center draws from many states in the region and are some of the top tourist destinations in that particular state or country. As with regional centers, the typical configuration is as an enclosed mall, frequently with multilevels. Super-Regional Shopping Centers typically contain 3 or more full-line department stores and may have one or more specialty junior department stores. More and more these type of centers are also being anchored by entertainment concepts including multiplex movie theaters and even museums/aquariums/adult gaming.

Festival Center/Theme Center: GLA Size: 80,000 – 250,000 square feet Land Area: 5-20 Acres Trade Area Radius: ½ mile to international

Concept: Urban, Tourist – Office Worker Oriented; Retail, Restaurant, Food Hall and Entertainment Anchor Ratio: Typically no anchors

Festival Centers aka Theme Centers are typically urban, adaptive reuse projects that because of their location will cater to tourists and nearby, densely populated office buildings. The first and best known of these projects is Faneuil Hall Marketplace in Boston, Massachusetts, USA which was developed by James W. Rouse and the Rouse Company. Other well known examples are South Street Seaport in New York City, New York, USA; Navy Pier in Chicago, Illinois, USA; Pier 39 in San Francisco, California; and Jackson Brewery, New Orleans, Louisiana, USA Festival Centers usually have multiple restaurant and entertainment tenants to attract tourists and business lunch/happy hour crowds. Festival Centers were a successful downtown renewal strategy, usually located on or near a water feature such as river, lake or ocean. Initially they featured a mix of local tenants but have now added national chain stores for additional drawing power.

Factory Outlet Center: GLA Size: 50,000 – 500,000 square feet Land Area: 10 – 50 Acres Trade Area Radius: 10 – 200 miles

Concept: Manufacturers (and Retailers); Discounted and Last Season Merchandise Anchor Ratio: Anchors are internationally known Name-Brands

Factory Outlets started as a phenomenon on the east coast of the United States of America as a way for manufacturers to monetize slightly damaged goods, manufacturing overruns, irregular products, “seconds” and retailer returns of unsold merchandise. Factory Outlet Centers (also known as Outlet Centers) are predominated by manufacturers’ outlet stores selling their own brands at a discount but will also now have ancillary retail, restaurants and even movie theaters and discount retailers. Factory Outlet Centers are typically not anchored, per se, however, you will usually find major brands at successful Outlet Centers which act as Anchors or in leasing parlance: “Bell Cow Tenants” because the other manufacturers/retailers follow them into the center. The first Factory Outlet Centers were built as a strip of stores with visibility to a major highway. As these centers are now built all over the world they can be configured as enclosed malls or laid out similar to Lifestyle Centers in a cluster of stores with connecting corridors.

They were originally located in rural and tourist areas because of prohibitions from department stores and specialty retailers about direct competition with their Full-Price merchandise. Many Brand-Name manufacturers actually had distribution agreements with retailers in regards to Minimum Advertised Pricing and Resale Price Maintenance agreements. Retailers were prohibited from selling or discounting their products below the Manufacturer’s List Price or Manufacturer’s Suggested Retail Price. This is also how the term “Off-Price” is derived in retail. In the “What’s good for the Goose is good for the Gander” category of developments, Department Stores prohibited manufactures from opening outlets near their stores which in turn meant Factory Outlet Centers were developed away from the major population centers where you would normally find Regional Malls. Factory Outlet Centers are also known for shorter leases with many tenants and developers agreeing to 1 year lease terms.

Net-Lease Single-Tenant (NLST): GLA Size: 1000 – 150,000 square feet Land Area: ½ – 20 Acres Trade Area Radius: 1 – 20 miles

Concept: Single Tenant; Stand Alone Tenant or located on Out-Parcel/Pad of Shopping Center Anchors: Not Applicable

Net-Lease Single-Tenant (NLST) real estate investments are one of the faster growing sectors of the entire real estate market. Retailers, Restaurants, Medical Providers and Financial Service tenants all are interested in the high visibility and flexibility that can be obtained with a stand alone building. Smart shopping centers developers and investors are spinning off out parcels or subdividing off anchor tenant parcels to recapitalize or improve investment returns by arbitraging the higher cap rates paid for Net-Lease Single-Tenant properties. NLST investors get the benefits of a hassle free “armchair” investment with a corporate lease (backed by a larger company with income sources spread out over a number of stores), a stable, long-term investment with limited management responsibilities for the property owner,and income growth through periodic increases.

Another popular retail real estate investment is the single-tenant Net Leased (NNN or Triple Net) retail property lease to a national credit chain store (think Walgreens, CVS, Advance Auto, and Dollar General, etc.) or bank branch (Chase, PNC or Bank of America). Single-tenant retail properties can be stand alone or actually located within a shopping center on an out-parcel or out-lot (in the front parking lot of the shopping center. A Single-Tenant Net-Lease property investment has many of the characteristics of buying a bond. The Investment Grade (IG) rating from Moody’s, Standard & Poor and Fitch are an important factor to consider along with the location aspects and condition of the property. Net-Leased Single-Tenant Retail properties have become highly sought after by individual investors, REITs, insurance companies, pension funds and other institutional investors. These larger, more sophisticated investors seek to invest in “Investment Grade” property assets which are tenants with credit ratings at least BBB- or higher by Fitch and Standard & Poor or Baa3 or higher by Moody’s. Many Net-Lease Single-Tenant Triple Net Retail properties are leased to publicly traded companies such as CVS, Walgreens, Autozone, 7-11; Dollar General, McDonald’s, Chick-Fil-A, Starbucks, Walmart, Whole Foods, Hobby Lobby or Kroger.

Urban Street Front Retail: GLA Size: 1000 – 150,000 square feet Land Area: ¼ – 1 Acres Trade Area Radius: ¼ – 1 ½ miles

Concept: Single Tenant; Stand Alone Tenant or located on Out-Parcel/Pad of Shopping Center Anchors: Not Applicable

Retailing has come full circle as retailers/chain stores expand for market share and try to penetrate densely populated cities they are expanding into Urban Street Front Retail real estate (sometime known as High Street Retail on the best shopping streets in gateway cities). Street front retail typically does not have parking but can be one or more stores extending as much as a city block. Many street front retail properties are the commercial condominium portion of a larger residential, office building and/or hotel Mixed Use Development ( MXD ) located in an urban center or city neighborhood.

Concordia Realty Corporation has been successfully connecting sound economics with experience in real estate for more than 28 years. We are a premier private real estate investment and management firm that creates value for our Investors, Tenants and the Communities where our properties are located. Our wide range of experience across a spectrum of real estate investments has consistently delivered superior returns. This experience has built a unique set of skills that helps to add value to all of our real estate ventures. We deliver increased returns to our investors, higher sales for our retail tenants, better living for our multifamily tenants, safer neighborhoods and higher valuations for our properties.

While Concordia Realty has done many different types of real estate investment, our main focus and most experience has been Retail Real Estate Investment, specifically Shopping Centers and Single Tenant Net Lease retail investments.

We hope to provide more educational information about Retail Real Estate Investment because there seems to be a need for better information available to the average investor.

Leave A Comment