Connecting Sound Economics with Experience in Real Estate

GET OUR LATEST SPECIAL REPORT HERE DO WE STILL NEED RETAIL REAL ESTATE?

Celebrating 34 Years of Connecting Sound Economics with Experience in Real Estate

TIRED OF WALL STREET? CONCORDIA REALTY IS INVESTING ON MAIN & MAIN

Founded in 1990, Concordia Realty Corporation has been successfully connecting sound economics with experience in real estate for more than 34 years. Concordia Realty provides the same investment opportunities and expertise that our institutional partners have enjoyed for decades.

CONCORDIA REALTY HAS THRIVED THROUGH FOUR FULL ECONOMIC CYCLES FROM 1990 THROUGH 2024 AND IS PREPARED TO WEATHER ANY COMING STORMS.

Concordia Realty is a premier private real estate investment and management firm that creates value for our Investors, Tenants, and the Communities where these properties are located.

Concordia Realty specializes in Retail Real Estate including Shopping Centers, Malls, and Single-Tenant Net-Lease Detail/Medical (“Medtail”) properties with an emphasis on value-added projects. Since the late 1990s, Concordia Realty has also selectively invested in Single Family House fix-and-flips, Condo Conversion projects, Condo Project workouts, Value Add Multifamily Apartment Buildings and, most recently, the Skydan Home Equity Preservation Fund to rescue distressed homeowners in financial crisis.

Concordia Realty’s wide range of experience has uniquely positioned us to redevelop and repurpose shopping centers that are experiencing disruptions related to higher sales for our retail tenants, create safer neighborhoods, and higher valuations for our properties.

CONCORDIA REALTY SUPPORTS THE 2024

Global Blockchain Real Estate Summit

Announcing

SKYDAN HOME EQUITY PRESERVATION FUND

Just in Time to Save Distressed American Homeowners

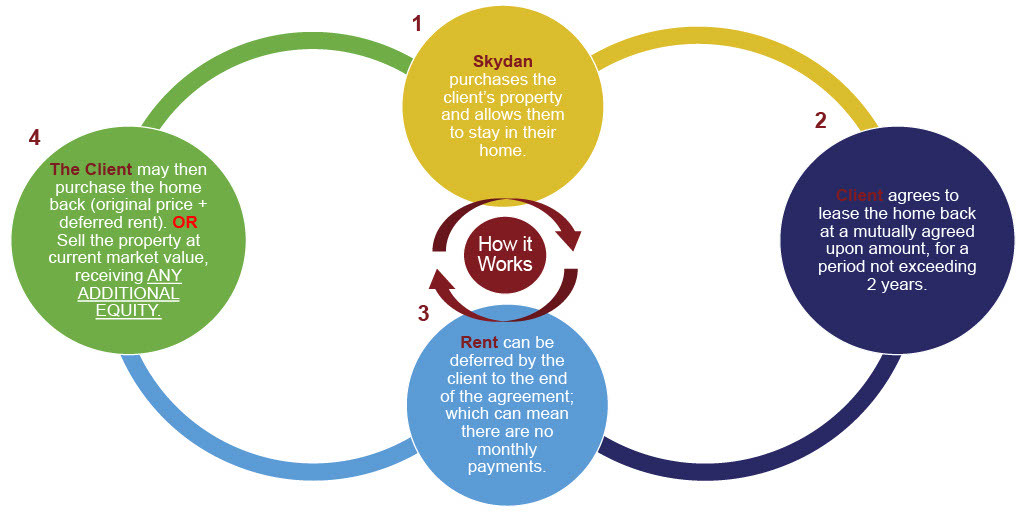

Concordia Realty is teaming up once again with our long-time partners at Skydan Equity Partners LLC to bring you the Skydan Home Equity Preservation Fund a unique Single Family Home Sale/Leaseback program that provides preferred income to investors by facilitating homeowners fast access to the untapped equity in their houses.

Better than a bank CD, this Preferred Equity fund is designed to pay high current yield with a short 2 to 21/2 year time duration. Investors are getting safe reliable returns with full possession of the collateral which is a 100% leased single family house purchased at a discount.

To make this story even better, Skydan’s clients are struggling with high inflation, all time high credit card debts and medical expenses. Banks are out of the market right now and Skydan fills the gap. Even if they were lending, banks make it difficult for homeowners to access the equity in their homes for a variety of reasons, including: Bad Credit, High Debt to Income, Credit Card Debt, Unpaid Property Taxes, IRS Liens and Bankruptcy. When Banks Say No, We Say Yes!

Skydan has a proven track record with over $22 million placed in the program.

HUNTER THOMPSON GIVES A MASTERCLASS ON RAISING CAPITAL FOR PASSIVE INCOME INVESTMENTS. Hunter is the founder of RaiseMasters and Asym Capital, along with and the host of the very popular Cash Flow Connections podcast. Hunter literally wrote the book on raising capital titled: Raising Capital for Real Estate: How to Attract Investors, Establish Credibility, and Fund Deals.

In this episode, Hunter, Michael Flight and Adam Carswell discuss how he continues to successfully raise millions of dollars for passive income investments and teaches others his process. Michael, Adam and Hunter also talk about why diversifying your investment portfolio with different asset classes of real estate, especially Triple Net properties, in various geographic locations yields great returns for investors.

Nothing But Net – NNN Show Episode 028: RAISING CAPITAL FOR NNN PROPERTIES