Skydan Home Equity Preservation Fund

JUST IN TIME TO SAVE DISTRESSED AMERICAN HOMEOWNERS

“Safe As Houses”

The Victorian expression ‘as safe as houses’ means ‘secure; with limited risk of failure.’ It shares that meaning with ‘as safe as the Bank of England’.in fact it is widely believed, that ‘as safe as houses’ referred to the relative security of investing in housing

INVESTMENT HIGHLIGHTS

$5 Million Preferred Equity Fund

Single-Family Houses Primarily in Stable Midwestern Markets

Houses Are Acquired at 40-60% of Market Value

NO Debt On Properties Or Fund

High Current Cash Flow with Most of Your Money Back within 2 Years

Skydan has $4-6 Million in Pipeline needing to be placed (including 2 repeat clients)

Feel-Good Financial Rescue Operation, including Credit Counseling for Clients

BACKGROUND

SKYDAN Equity Partners LLC is a residential sale/leaseback company providing alternative financial solutions to homeowners who are experiencing financial hardship.

We offer hope to homeowners in financial need. Our goal is to help customers access their home equity wealth before they have exhausted all of their options. We provide a simple alternative to traditional bank loans.

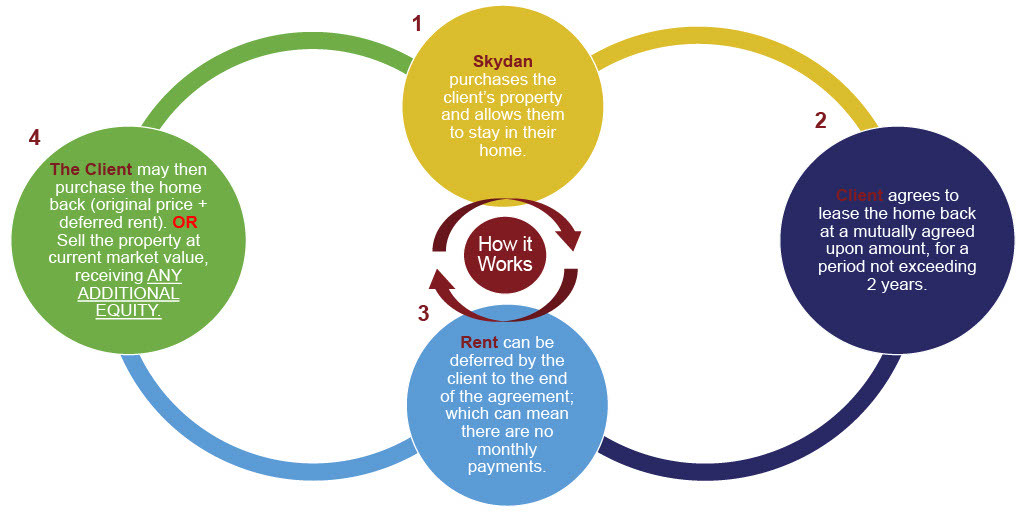

With banks on the sidelines, this fund is coming to the rescue of hard-pressed homeowners that have equity in their houses and nowhere else to turn. Skydan purchases the client’s property and allows them to stay in their home. The client agrees to lease the home back at a mutually agreed-upon rental amount for a period of two years or less. The client may then purchase the home back (original price + deferred rent) or sell the property at the current market value, receiving all additional equity.

We like to say it is the Bankers Business Plan without any counterparty risk or credit risk since the fund owns the houses. Better yet the fund owns the houses at a significant discount to market values. Housing prices would need to collapse 35 to 50% before the principal of the fund would be at risk. The Midwestern markets where the properties are located have never had a drop like that in history. What is more likely? Inflation increases asset values, especially houses, and more importantly a structural deficit in housing supply.

What We Do

We offer hope to homeowners in financial need. Our goal is to help customers access their home equity wealth before they have exhausted all of their options. We provide an alternative to traditional bank loans.

The Problem

Even if they were lending, banks make it difficult for homeowners to access the equity in their homes for a variety of reasons, including: Bad Credit, High Debt to Income, Credit Card Debt, Unpaid Property Taxes, IRS Liens and Bankruptcy. When Banks Say No, We Say Yes!

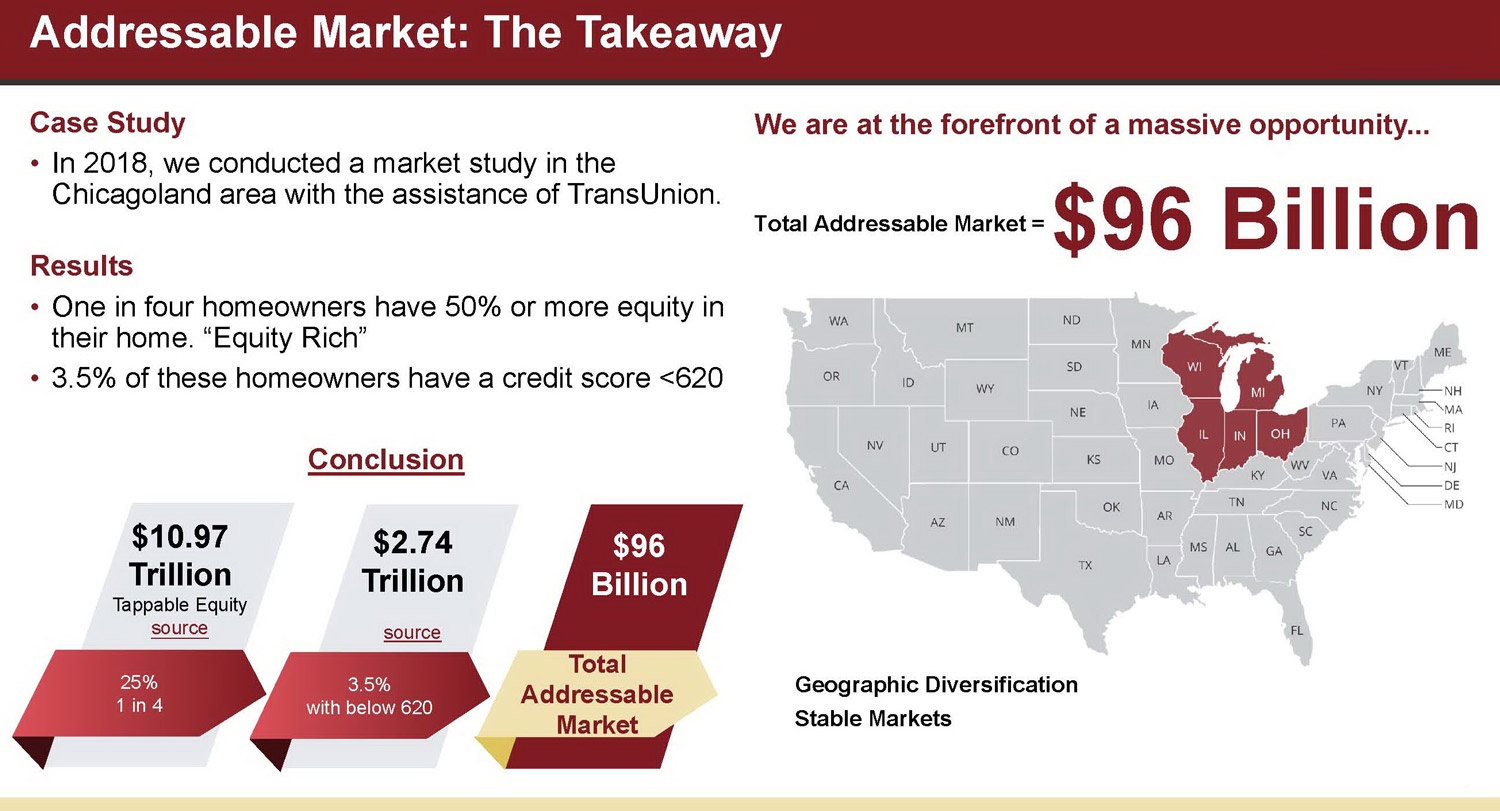

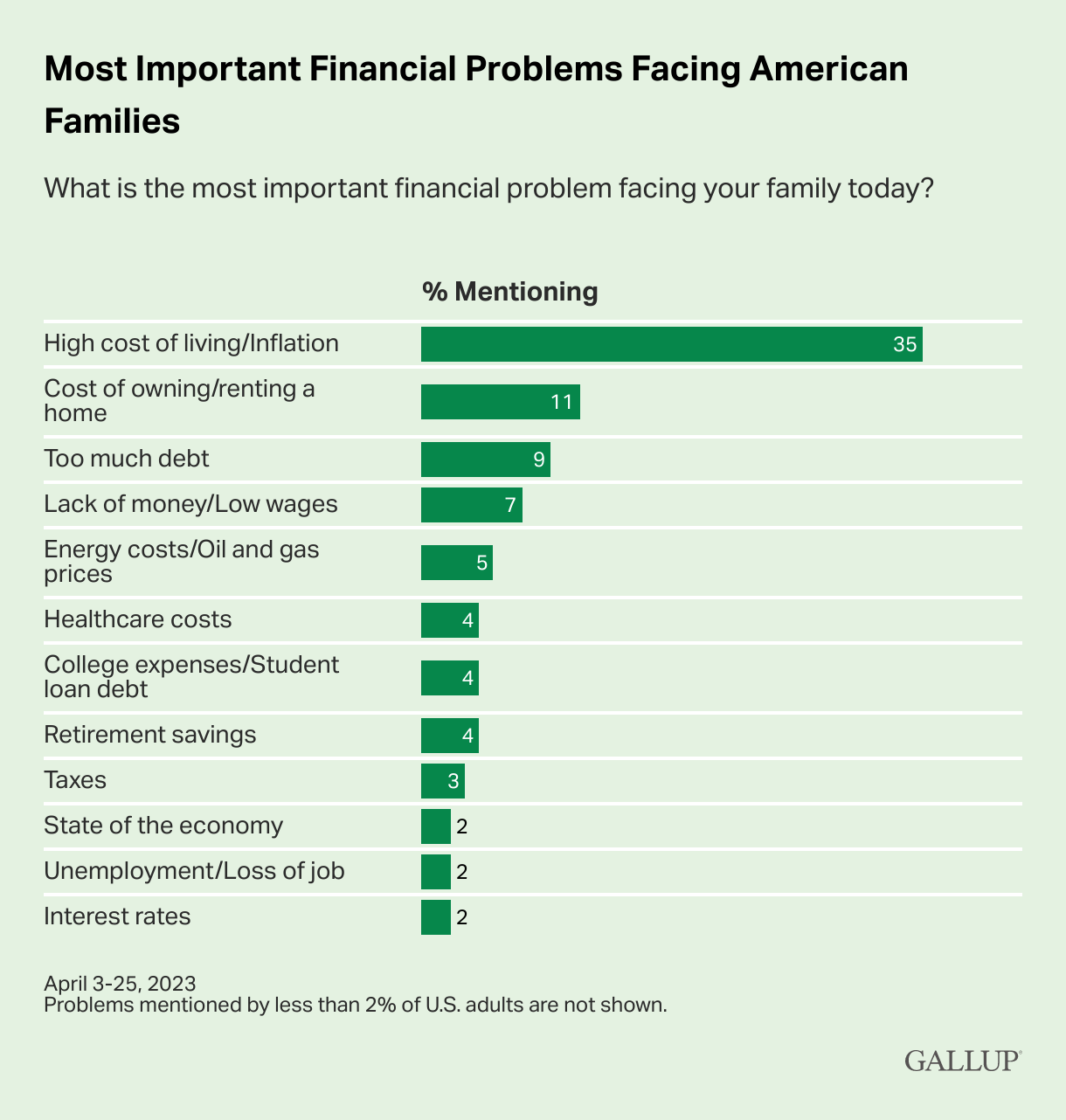

Gallup Poll: The Most Important Financial Problems Facing American Families In 2023

A recent Gallup poll showed that inflation is making it harder for people to keep up with bills and debt. Bank failures are further constraining any assistance or lifelines to Americans hit hard by government mandated shutdowns, inflation and high gas prices. Banks make it difficult for homeowners to access the equity in their homes for a variety of reasons, including:

- Banks Have Stopped Lending HELOCs and Home Equity Loans

- Loss of Income

- Medical Expense

- Bad Credit

- Unpaid Property Taxes

- Bankruptcy

- Credit Card Debt

- High Debt to Income

- IRS Liens

With banks on the sidelines, this fund is coming to the rescue of hard-pressed homeowners that have equity in their houses and nowhere else to turn.

Our Solution

Our unique Home Equity Preservation sale/leaseback program provides clients fast access to their equity.

The Skydan Equity Preservation Fund (“SEPF”) is a unique Sale/Leaseback program that provides preferred income to investors by facilitating homeowners fast access to the untapped equity in their houses.

Skydan purchases the client’s property and allows them to stay in their home. The client agrees to lease the home back at a mutually agreed-upon rental amount for a period of two years or less. The client may then purchase the home back (original price + deferred rent) or sell the property at the current market value, receiving all additional equity.

A Medical Emergency That Would Have Put Her Into Bankruptcy

- A homeowner needed money fast for a medical emergency (she did not have insurance). She was prepared to sell the house for $150,000 (less than half its value).

- SKYDAN purchased the house for $190,000 giving her immediate cash. We then resold the property for $319,000.

- The homeowner received the original $190,000 and an additional $113,000, once it was sold and closed.

- Ultimately, if she had not participated in our program, she would have received much less

General & Financial Disclaimer

This Business Plan contains privileged and confidential information and unauthorized use of this information in any manner is strictly prohibited. This Business Plan is for informational purposes and not intended to be a general solicitation or a securities offering of any kind. The information contained herein is from sources believed to be reliable, however no representation by Concordia Equity Partners LLC or Skydan Equity Partners LLC (Sponsors), either expressed or implied, is made as to the accuracy of any information on any properties and all investors should conduct their own research to determine the accuracy of any statements made. An investment in this offering will be a speculative investment and subject to significant risks and therefore investors are encouraged to consult with their personal legal and tax advisors. Neither the Sponsor(s), nor their representatives, officers, employees, affiliates, sub-contractor or vendors provide tax, legal or investment advice. Nothing on this website or in written documents is intended to be or should be construed as such advice.

The SEC has not passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials. However, prior to making any decision to contribute capital, all investors must review and execute a Private Placement Memorandum and related offering documents. The securities are subject to legal restrictions on transfer and resale and investors should not assume they will be able to resell their securities. This offering is for Accredited Investors only.

Potential investors and other readers are also cautioned that these forward-looking statements are predictions only based on current information, assumptions and expectations that are inherently subject to risks and uncertainties that could cause future events or results to differ materially from those set forth or implied by such forward looking statements. These forward-looking statements can be identified by the use of forward-looking terminology, such as “may,” “will,” “seek,” “should,” “expect,” “anticipate,” “project, “estimate,” “intend,” “continue,” “ target,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. These forward-looking statements are only made as of the date of this executive summary and Sponsors undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

This Business Plan further contains several future financial projections and forecasts. These estimated projections are based on numerous assumptions and hypothetical scenarios and Sponsor(s) explicitly makes no representation or warranty of any kind with respect to any financial projection or forecast delivered in connection with the Offering or any of the assumptions underlying them.

This Business plan further contains performance data that represents past performances. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data presented. All return examples provided are based on assumptions and expectations in light of currently available information, industry trends and comparisons to competitor’s financials. Therefore, actual performance may, and most likely will, substantially differ from these projections and no guarantee is presented or implied as to the accuracy of specific forecasts, projections or predictive statements contained in this Business Plan. The Sponsor further makes no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown in the pro-formas or other financial projections.

Please check with your tax and legal professional as Sponsors do not provide tax or legal advice and the above is not intended to or should be construed as such advice. Your specific circumstances may, and likely will, vary.

DISCLOSURES, LEGAL AND TAX COUNSEL: Concordia Realty Corporation is a licensed Illinois Real Estate Broker – License #478.006849. Concordia Realty Corporation, Concordia Equity Partners LLC, Concordia Realty Management,Inc. (collectively “Concordia Realty”) and their affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction or undertaking. Concordia Realty and Concordia Equity Partners LLC highly encourage individuals and investors to seek the counsel of a qualified attorney as well as seek the counsel of a tax professional or Certified Public Accountant (CPA) to determine if there are any potential tax liabilities or consequences as a result of anything contained herein. NO GUARANTEE: All users of this website should understand there are NO GUARANTEES of any success, outcome or profitability of any transaction or undertaking, expressed or implied by Concordia Realty, Concordia Equity Partners LLC or Skydan Equity Partners LLC any of its members, shareholders, officers or affiliates and will NOT be liable for any financial or other losses or damages incurred as a result of any undertaking. Go HERE to view complete DISCLOSURES.