CRC032 Security Tokens Realised 2020

SECURITY TOKENS WILL CHANGE REAL ESTATE INVESTMENT

Michael Flight participated in the SECURITY TOKENS REALISED conference held in London during January 2020 for Liberty Real Estate Fund. We had the good fortune to talk to very smart people from Morgan Stanley, Citibank, ING and individuals like Alon Goren, Alpesh Doshi and Matthew C. Le Merle (INVESTOR IN 10 BLOCKCHAIN UNICORNS). Many people have an adverse reaction to hearing anything remotely similar to crypto, ICO, or blockchain, not the least are some of the scams plaguing the industry. Security Tokens are digitized securities that will bring regulation and legitimacy to digital assets.

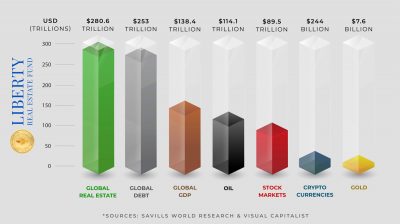

REAL ESTATE is one of the LARGEST ASSET CLASSES in the world. It is bigger than the stock and bond markets combined. Security Tokens will unlock the value and create liquidity for some of the $270 trillion worth of real estate worldwide.

As the year moves forward we will be producing more informative articles on the tokenization of real estate but for now the conference highlighted Six Key Benefits of Security Tokens:

- Intrinsic value

- Liquidity (a developing secondary market for fractions of large real estate investments)

- Regulatory legitimacy

- Investor transparency

- Access to global investor base and global investments

- Efficiency and scalability

The benefits of blockchain and smart contracts to investors should be increased liquidity, lower costs and ease of access to high quality investments. Leveraging blockchain technology, digital security tokens will offer a new, safe and efficient way for all investors to participate in the highest performing asset class.

Why Buy Security Tokens?

Security tokens are issued via blockchain technology by businesses to investors; these security token offerings (STOs) are distributed to investors as digital tokens in exchange for money, representing the actual investment in a specific business. The security token has intrinsic economic value to the investor that gives them tangible ownership of physical or virtual assets, property or shares, participation in management, profit shares, dividend payments, and/or credit commitments of the company chosen to invest in.

Liquidating assets becomes even easier with security tokens, as well; any tangible asset can be tokenized, meaning its value can be divided into any number of digital “certificates” in the form of security tokens then sold to any amount of people with no minimum on investments–selling to one or thousands. Security tokens give companies more flexibility in liquidating assets, and the same goes for investors wanting to liquidate their security tokens on exchanges.

With the requirement of businesses’ full compliance to SEC regulations, such as data sharing, procedures of integrating a new investor, paying damages to all investors, and extensive investigations into the token listings, security tokens are tamper-resistant and highly secure. In fact, STOs are traded on specialized exchanges and registers with the SEC, greatly reducing the risk of investing in fraudulent companies and proving their legitimacy.

Blockchain technology not only assures the credibility of a potential investment opportunity, but also offers more transparency to investors who purchase security tokens. Since the SEC provides companies with STOs to disclose their information to the public, investors can analyze potential investments for themselves before buying security tokens. All transactions and actions, without revealing the identities of participants, can be audited by investors with security tokens by tracking holdings of tokens or viewing the smart contracts of the tokens.

The process of buying and selling security tokens is also made easy; investors need only register on the STO website, then can begin trading money for tokens–a quick, simple transaction process that anyone can take part in. As a result of this simple, open trading system, security tokens can be purchased by anyone who has access to the internet, opening exchanges to global markets and investors. Security tokens act as a disintermediate between any interested investor and businesses with STOs, removing the need for tertiary markets.

By tokenizing securities, blockchain technology combined with the smart contracts can eliminate most of the physical paperwork when investing in the market, digitizing important data on market statuses and increasing the efficiency of investments. The online records will allow investors the ability to track financial reports and their accuracy, and check on the status of documents in real time, all individually. Security tokens increase the scalability of market information to all participants while efficiently updating the information as it becomes publicly available.

It is why Concordia Equity Partners LLC has partnered with the Boro Group LLC to create Liberty Real Estate Fund, the world’s first net lease security token offering

Speakers

Jonathan DeCarteret

James Welsh

Uwe Diegel

Cedric Bouche

Ioana Surpateanu

Ivo Sauter

Domenic Kurt

Shane Kehoe

Lawrence Wintermeyer

Matthew Le Merle

Tim Mitja Zagar

Oded Shoshany

Juan Vargas

Rob Nance

Daniel Coheur

Alexandre Azouley

Andrew Flatt

David Pleasance

Joel Camacho

Max Yakubowski

On Yavin

Herve Francois

Alexandra Rimpu

Brad Douglas

Martin Bartlam

Jeffrey Sweeney

Luc Falempin

Katia Lang

Stefan Schütze

Nikolas Stefanou

Daemon Bear

Kamila Bobinska

Swen Werner

En Hui Ong

Aymeric V Bruneau

Saar Levi

Alex Batlin

Misun Cho

Helen Disney

Phil Mochan

Olivier Pigeon

Ben Mason

Graham Rodford

Dr. Lidia Bolla

Réda Berrehili

Marina Titova

Lex Sokolin

Nassim Olive

Richard Foster

George Salapa

Usman Ahmad

Hugh Madden

Tomer Sofinzon

Barry James

Suchitra Nair

Teana Baker-Taylor

Ami Ben-David

Sean Donovan-Smith

Remi Gai

Tommy Varhaugvik

Nicole Anderson

Security Tokens Realised Summit

London, England, UK

January 23rd-24th, 2020

Security Tokens Realised Global Conference at the Grand Connaught Rooms, 61-65 Great Queen Street, London, WC2B 5DA, UK

For more information on Concordia Realty, contact us here:

Leave A Comment